BlackBerry maker Research In Motion Ltd. (Nasdaq: RIMM - News) sliced its earnings outlook for the year and said it would start laying off employees, in grim results that suggest its aging smartphone line and delays in introducing new devices are eroding its business faster than anyone expected.

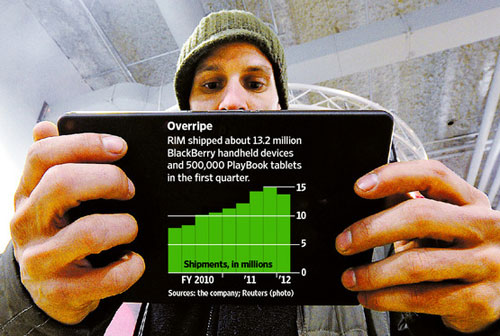

RIM, which has been losing ground to rivals and cutting its financial targets, said it pulled in less revenue and sold fewer BlackBerry phones than expected for the first fiscal quarter ended May 28. It posted the first quarterly drop in BlackBerry sales since 2005.

The company said the bad news will continue through the current quarter, which ends in August, since delays certifying its latest slate of phones mean they won't start coming out until late August, missing an important back-to-school sales season.

Shares of RIM tumbled $5.15, or 15%, to $30.18 in after-hours trading following the report, after closing at $35.33 on the Nasdaq Stock Market Thursday. The stock has lost nearly half its market value so far this year, including the after-hours decline.

To help boost results, RIM said it plans to "streamline operations" by reducing headcount and reallocating resources to high-growth projects, in a program it began at the beginning of the quarter.

[More from WSJ.com: RIM's Waterloo Moment]

RIM executives declined to say how many jobs would be eliminated. The company employed about 17,500 people at the end of February.

Executives said the pain should end soon, after the company starts releasing a new slate of smartphones from late August, featuring hardware and software upgrades.

"We truly believe we are approaching the end of this difficult transition," said co-chief executive Mike Lazaridis, in a rare appearance on an earnings conference call.

The Canadian company reported a first-quarter profit of $695 million, or $1.33 a share, down 9.6% from a year earlier. Revenue rose 16% to $4.9 billion, below RIM's revised guidance for $5.2 billion.

The company also reported sales of 13.2 million BlackBerrys in the latest quarter, down from 14.9 million in the February quarter and below the low-end of its forecast.

The results were the latest sign of trouble for the company, which is watching handsets from rivals like Apple Inc. (Nasdaq: AAPL - News) eat away at its once-dominant share of the smartphone market. RIM hasn't released a new BlackBerry model for nearly a year as it tries to rejuvenate a product line that's been criticized as clunky, under-powered and stodgy.

[More from WSJ.com: Facebook Seeks to Shape Mobile Apps Software]

It has seen its share of sales in the benchmark North American market fall to 16.5% at the end of the first quarter of 2011 from 41.3% in the year earlier period, according to research firm Gartner.

Some observers worry RIM is fast following in the path of Finnish handset maker Nokia Corp. (NYSE: NOK - News), which recently issued a steep second-quarter revenue warning, citing market-share loss to rival smartphones, most notably low-end devices powered by Google Inc.'s (Nasdaq: GOOG - News) Android software.

RIM has pinned its hopes on devices that run on a new operating system called QNX, the first of which is the PlayBook tablet. But RIM isn't expecting to release any QNX-based smartphones until early next year.

On Thursday, RIM said it won't begin to release interim phones that run on an upgraded version of the old BlackBerry operating system until "very late" in August. That is later than analysts had hoped, and means the devices won't contribute to second-quarter revenue.

[More from WSJ.com: A Permabull Bails on RIM]

The PlayBook itself has gotten off to a reasonable start, despite early, poor reviews. RIM said Thursday it shipped 500,000 PlayBook units during the first quarter. The seven-inch device doesn't have a cellular connection and can't access corporate email unless it is linked to a BlackBerry phone. It also doesn't have the huge library of applications tapped by Apple's iPad or tablets that run on Android-based devices.

RIM's marketing chief quit a few months before the PlayBook was about to be launched, and its co-chief executives have sometimes seemed out of sync about what the tablet should do and whether its main target should be corporations or ordinary consumers.

Earlier Thursday, RIM said its chief operating officer, Don Morrison, is taking a medical leave and is expected to return later this year. Mr. Morrison, who joined RIM in 2000, oversees the company's domestic and international operations.

The company also said Larry Conlee, a former RIM chief operating officer, has returned as a special adviser. RIM didn't say when Mr. Conlee returned, and didn't define his role. The company said he has served in an advisory capacity at various times since his retirement in 2009.

For the full fiscal year, the company now projects a profit of $5.25 to $6 a share, well below its previous forecast for $7.50 a share. For the current quarter, RIM sees earnings of 75 cents to $1.05 per share on revenue of $4.2 billion to $4.8 billion, below analysts' expectations for $1.40 and $5.46 billion, respectively.

|

-- Ben Dummett contributed to this article.